![]() Download Full Storage Study [PDF - 1.27 Mb]

Download Full Storage Study [PDF - 1.27 Mb]

![]() Download Study Summary Highlights [PDF - 828 Kb]

Download Study Summary Highlights [PDF - 828 Kb]

U. S. Market Evaluation for Energy Storage

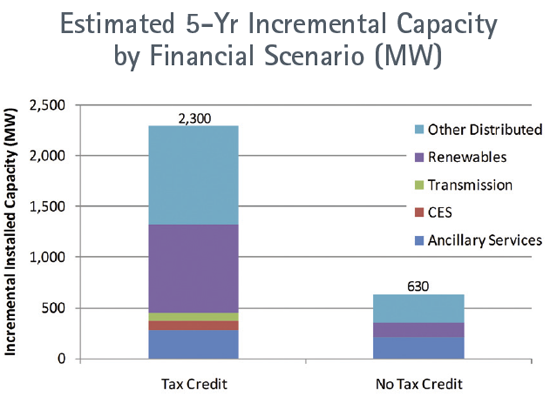

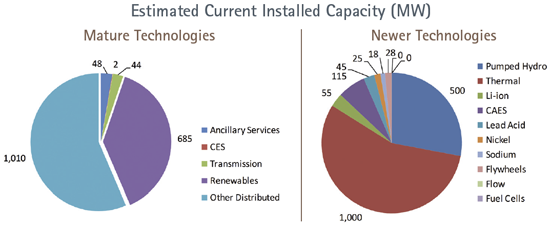

A study, conducted by KEMA for the Copper Development Association, to determine the current market - and the future potential - for grid energy storage in the United States, reveals that the current market is robust and the potential market is huge. Estimates show that between 2 to 4 gigawatts (GW) of energy storage could be developed over the next five years depending on financial incentives.

The report found an array of opportunities in the storage market such as:

- Government and venture capitalist investments continue to grow the storage market;

- Storage industry is on the cusp of commercialization and in a state of acceleration due to the demonstration projects that are continuing to test and define grid applications;

- Technology advancements over the last few years have enabled storage to grow from a "future concept" to an accepted tool in certain applications;

- Storage has a strong role in facilitating renewables into the U.S. Grid;

- Opportunities for global energy storage are significant;

- Utilities are predicted to be the largest future development.

Due to copper's key benefits of reliability, efficiency, durability and safety, copper plays a key role in the fundamental design of battery cells. The copper content of storage installations appears to be significant, ranging from 0.3 to 4 tons per MW.

Where Is Storage Potential in The U.S.?

Within the U.S., industry analysts forecast that $240 billion will be invested in storage grid applications over the next 10 years. Numerous policy decisions will positively impact potential revenue streams for energy storage:

| Near-Term | ISO/RTO Firming Requirements (PJM, NYISO, ISO-NE, MISO) |

| Mid-Term | FERC Final Rule (RM11-7-000; Final Order No. 755, California State Law (AB 2514), Renewable Portfolio Standards |

| Long-Term | US Storage Act of 2011 |

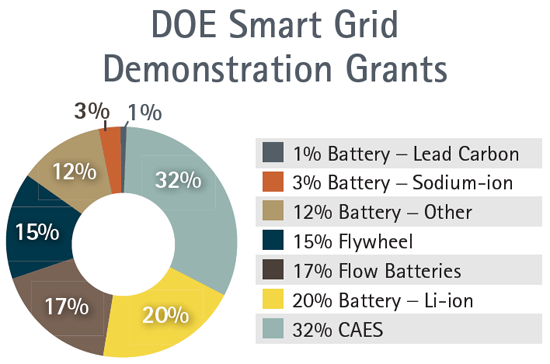

Overall, government support and investment is strong with the Department of Energy (DOE) Smart Grid Demonstration Grants project values reaching $772 million with an associated MW of 537.3.

Energy Storage segment led all cleantech investment during the third quarter of 2011. This segment raised $421 million during Q3 2011, representing a 1,932 percent increase during the same period last year and has raised a total of $865.2 million throughout 2011. - Greenbiz.com

What Are the Global Opportunities?

Global estimates over the next 10 to 20 years are at upwards of 300 GW in size, which translates into $200-$600 billion in value. The largest markets are the United States, Western Europe and China. Market drivers are energy independence and security; smart grid investments; time of use/peak demand rates; increase in renewables and distributed generation; and government policies, incentives and regulations.

Source: "Market Evaluation for Energy Storage in the United States" prepared for the Copper Development Association, Inc. (CDA) by KEMA, Inc, Fairfax, Virginia, copyright 2012.