Introduction: Meeting the Growing Demand for High-Performance Materials in OEM

As the backbone of advanced manufacturing, Original Equipment Manufacturers (OEMs) are driving a new wave of industrial innovation, relying on materials that offer exceptional durability, conductivity, and efficiency. Copper, with its unmatched combination of strength, resilience, and conductivity, stands out as a critical resource within this rapidly evolving landscape. From automotive to aerospace, copper enables OEMs to meet today’s rigorous standards, particularly as demand grows for products with enhanced energy efficiency and sustainability.

In this transformative era, known as Copper Age 2.0, the U.S. is firmly positioned to ensure a robust supply chain through an “all of the above” strategy. By scaling domestic mining and refining, amplifying recycling efforts, and maintaining strong trade relationships, the U.S. has the resources to meet current and future OEM needs. This comprehensive approach ensures that American industries can leverage copper’s unique benefits, electrifying innovation while strengthening economic and supply chain resilience.

The Growing Need for High-Performance Materials in OEM

As global industries evolve, OEMs face increasing pressure to integrate high-performance materials that meet elevated standards of reliability, energy efficiency, and sustainability. Copper, with its exceptional conductivity, corrosion resistance, and thermal properties, is essential for OEMs striving to meet these demands.

Its applications span diverse sectors. In automotive, copper is irreplaceable for EV wiring, motor windings, and battery technology. Telecommunications relies on copper to power seamless data flow. Aerospace utilizes copper alloys in aircraft engines and fuselages for greater fuel efficiency. In healthcare, copper's antimicrobial properties are vital for infection control in medical devices. Even consumer electronics rely heavily on copper for wiring, heat sinks, and electromagnetic shielding.

The shift toward electrification and automation further intensifies the need for copper. OEMs require materials that can handle high electrical loads, dissipate heat effectively, and endure harsh operational environments. A steady and scalable copper supply is therefore critical to drive OEM innovation and maintain America's manufacturing leadership.

Copper's Role in Data Centers

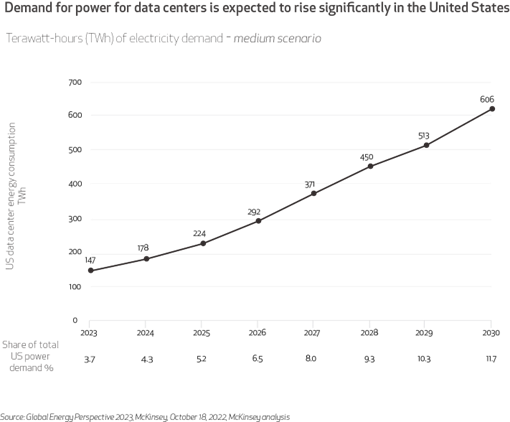

The reliance on this critical material extends beyond traditional manufacturing and into the rapidly evolving digital landscape. As data centers become increasingly vital to our digital world, consuming massive amounts of power—often surpassing the energy needs of small cities—the role of copper is more critical than ever. This critical material is essential to the rapidly evolving digital landscape, with McKinsey analysis projecting the United States to be the fastest-growing market for data centers, growing from 25 GW of demand in 2024 to more than 80 GW of demand in 2030 [₁]. In this dynamic environment, copper is proving to be the metal of choice for power distribution and efficient energy management. Copper's exceptional conductivity makes it ideal for the transformers, busbars, and other power distribution equipment that large data centers require to supply hundreds of megawatts to servers, cooling systems, and other infrastructure. Beyond its role in power distribution, copper enhances operational efficiency by minimizing thermal stress and keeping energy losses low. This helps reduce cooling demands, lowering energy costs and enhancing sustainability. For example, CDA studies indicate an average copper intensity of 27 metric tons per megawatt in U.S. data centers, a figure likely to increase with the adoption of AI-driven data processing and high-density storage needs. Furthermore, copper is used in heat exchangers and cooling systems to efficiently transfer heat out of data centers, maintaining optimal temperatures for equipment performance. As the U.S. leads in global data center construction, copper’s role is vital in supporting the growth of this high-demand sector with durable, efficient, and sustainable solutions.

[₁]

Copper Supply: Is There Enough to Meet Future Demand?

With demand for copper surging across industries, particularly in high-performance sectors like OEM, questions arise about whether supply can meet future needs. Fortunately, the U.S. is well-equipped to secure its copper requirements through a comprehensive “all-of-the-above” approach. This strategy integrates increased mining and refining capacity, expanded recycling programs, and sustained trade with reliable international partners, ensuring copper availability while enhancing supply resilience.

Domestically, the U.S. holds approximately 275 million metric tons in copper reserves and resources, more than enough to meet projected demand as extraction, processing, and recycling systems are optimized. However, the development of new mines and expansion of refining capacity face regulatory and logistical challenges. Permitting alone can take nearly 30 years, making it essential for the U.S. to streamline these processes if it is to sustain a robust supply chain.

Recycling is another critical component, supplying more than 30% of U.S. copper demand and offering an environmentally friendly supplement to mined copper. Strengthening domestic recycling infrastructure can reduce reliance on imports and help balance the supply as demand continues to grow. Additionally, strong trade relationships with copper-rich nations like Chile, Canada, and Peru bolster the U.S. supply chain and provide a safety net as domestic production catches up to demand.

This multifaceted approach ensures that the U.S. has sufficient copper to meet the demands of OEMs, data centers, and beyond, supporting the growth of these industries while positioning copper as a foundational resource for America’s future industrial landscape.

Conclusion: Powering the Future of American Industry with Copper

As the U.S. stands on the brink of an industrial renaissance, copper remains fundamental to driving innovation across sectors—from OEM manufacturing to data centers and renewable energy. Copper’s unmatched qualities of durability, conductivity, and recyclability make it an invaluable resource, allowing OEMs and other industries to meet increasing performance and sustainability standards.

Through a comprehensive Copper Age 2.0 strategy, the U.S. has the capability to meet these future demands. This means bolstering domestic mining and refining, while ensuring responsible and sustainable practices. It requires expanding recycling efforts and investing in innovative technologies to maximize resource recovery. And it necessitates maintaining strong, reliable trade partnerships to ensure a stable and diversified supply chain. This all-encompassing approach not only secures a reliable copper supply but also supports American competitiveness, job creation, and sustainability goals.

But the responsibility doesn't lie solely with policymakers. Industry leaders must prioritize sustainable practices and invest in research and development to unlock new applications for copper. Investors must recognize the long-term value proposition of copper and support companies committed to responsible sourcing and production. And consumers must demand products that prioritize durability and recyclability, driving a shift towards a circular economy.

With copper at its core, and a commitment to collaborative action, American industry is well-prepared to tackle the challenges of a rapidly evolving market. By embracing Copper Age 2.0, the U.S. can ensure its manufacturing, infrastructure, and energy systems are resilient, sustainable, and equipped to power a brighter future for generations to come.